Little Known Facts About Paypal Business Loan.

Wiki Article

Facts About Paypal Business Loan Revealed

Table of ContentsExcitement About Paypal Business Loan7 Simple Techniques For Paypal Business LoanOur Paypal Business Loan StatementsThe smart Trick of Paypal Business Loan That Nobody is DiscussingWhat Does Paypal Business Loan Do?

You'll have several alternatives when checking out startup fundings, including SBA lendings, tools funding, lines of credit history, brief term car loans, as well as company credit score cards. The settlements will certainly be based upon the quantity of the funding, as well as the passion rate, term, as well as collateral. To qualify, it's generally necessary to have a credit history rating of 680 or higher.With an organization purchase lending, you'll obtain anywhere from $5,000 to $5,000,000. One of the best aspects of these loans is that interest prices start as reduced as 5.

These beneficial prices suggest you'll conserve a significant quantity of cash over the life time of the finance. Obtaining an organization procurement lending can supply a jumpstart to your company, as purchasing a franchise business or existing organization is a terrific way to step right into a functional business without the gruelling job of developing it from scratch.

While the application varies relying on whether you're getting a franchise business or existing business, you can intend on loan providers examining elements such as your credit report, business period, and also income. You'll need to provide documents of business's performance as well as evaluation, along with your very own business plan and also financial estimates.

Not known Factual Statements About Paypal Business Loan

There's no issue with your business bring financial debt. The question is whether your service can handle its financial debt obligations. To obtain a bead on your service debt protection, a loan provider assess a knockout post your cash money circulation and also financial obligation repayments.

Lenders additionally care concerning the state of your business debt. What matters is whether the amount of debt you're lugging is proper contrasted to the size of your service as well as the market you're working in.

Some Known Questions About Paypal Business Loan.

Lenders are more motivated to collaborate with you if your business is trending in the appropriate direction, so they'll intend to ascertain what your standard earnings development will more than time. If your own lands at or above the standard for your market, you're in wonderful shape. If you fall listed below the average, intend on there being some feasible challenges in your search of funding.The best one for your company will depend on when you require the money and also what you require it for. Right here are the 10 most-popular kinds of company finances.

Best for: Companies looking to broaden. Debtors that have great credit report and also a solid company as well as that do not want to wait long for financing. The Local business Management guarantees these fundings, which are supplied by financial institutions and other loan providers. Settlement durations on SBA loans depend on how you prepare to make use of the cash.

Prices will certainly depend on the worth of the devices and also the strength of your service. You can obtain competitive prices if you have solid blog here debt and also organization funds.

Unknown Facts About Paypal Business Loan

Disadvantages: Smaller loan quantities. Best for: Start-ups and also services in disadvantaged communities.As we have actually talked about, there are several types of service loansand the appropriate one for your business eventually comes down to a variety of variables. At the end of the day, each kind of small service funding is made for a different organization need. You'll require to consider your debt, your business's funds, the size of time you've been running, read more as well as your reason for the funding prior to narrowing down your options.

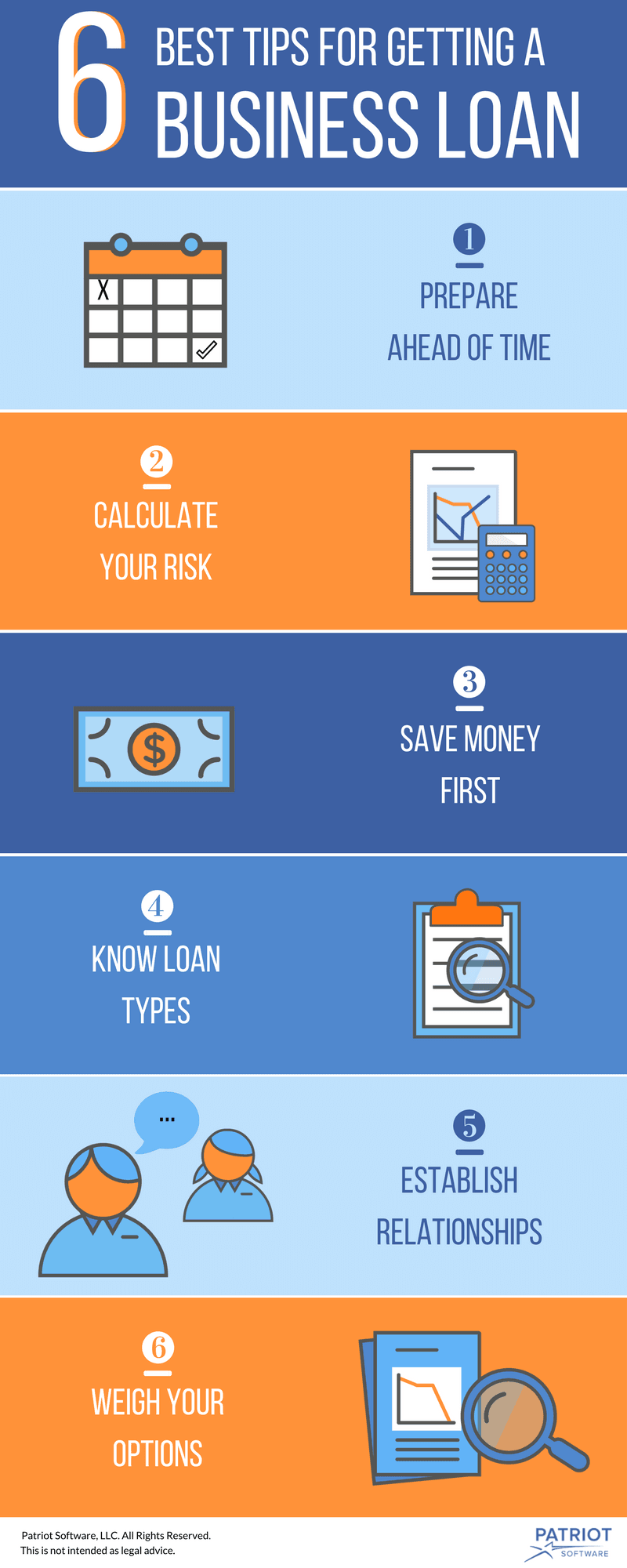

You'll likewise find out about numerous alternatives that you can capitalize on if a little service funding is not your best funding option. There are specific things that every tiny company proprietor must understand prior to heading down the application procedure. Here are the five main facts to recognize: They're all different.

The Definitive Guide for Paypal Business Loan

There are a whole lot of frauds. Know your debt service coverage ratio. Prepare to back your service. Allow's start: Bank loan are as diverse as the local business proprietors that look for them. Not every lender works in the same fashion, and even within the exact same borrowing company, you'll discover different sorts of lendings.Report this wiki page